Trump Continues Criticism of Fed, Renews Threat on China Imports Timiraos&Torry 英文联播

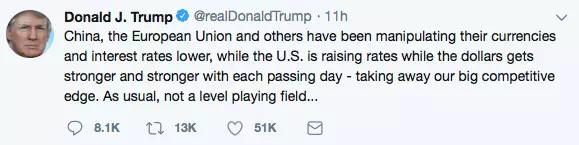

President Donald Trump signaled for a second straight day his frustration with the Federal Reserve’s policy of gradually raising interest rates, saying it would undermine his campaign to boost U.S. economic growth and reduce trade deficits. 总统唐纳德·特朗普连续两天表达了对美联储渐进性加息政策的不满,表示后者会破坏他促进美国经济增长并降低贸易赤字的行动。 In tweets on Friday, Mr. Trump said the Fed’s efforts hurt the U.S. economic expansion, and he accused China and Europe of manipulating their currencies to hurt the U.S. on trade. 周五的推文中,特朗普先生说,美联储的行为破坏了美国经济扩张,他指责中国和欧洲操纵货币,从而伤害了美国贸易。

The tweets came shortly after CNBC broadcast an interview with Mr. Trump in which the president said he was prepared to impose U.S. tariffs on $500 billion worth of imports from China as part of his push to narrow U.S. trade deficits. In a portion of the interview that aired Thursday, the president said he wasn’t happy about Fed rate increases. 发推特不久前,接受CNBC采访的特朗普先生说他准备对价值5000亿美元的中国进口商品征收关税,旨在缩减美国贸易逆差。周四播放的采访中,总统表示对美联储加息表示不满。 The central bank’s campaign to slowly raise interest rates “hurts all that we have done,” he wrote Friday. “The U.S. should be allowed to recapture what was lost due to illegal currency manipulation and BAD Trade Deals. Debt coming due & we are raising rates — Really?” 他周五写道,美国央行缓慢提升利率“伤害了我们做的一切”。“美国应该收复失去的一切,造成这一切的原因是非法货币操纵和糟糕的贸易协议。债务要到期了,我们却在加息——真不敢相信。” In effect, Mr. Trump signaled his desire to enlist the Fed in his broader trade campaign. Higher interest rates in the U.S. could raise the value of the U.S. dollar against other currencies, which would make it harder to narrow the trade deficit. 事实上,特朗普表明自己希望美联储参加他的贸易战。在美国加息会让美元对其他货币升值,这使缩减贸易逆差更加困难。 A stronger greenback makes U.S. exports relatively more expensive on world markets. Mr. Trump regards the trade deficit as an important scorecard of economic vitality, though most economists say it isn’t. 强势美元让美国出口商品在世界市场上更加昂贵。特朗普先生认为贸易逆差是经济是否有活力的标志,尽管多数经济学家不这样认为。 A spokeswoman for the Fed’s board in Washington declined to comment. 美联储华盛顿委员会发言人拒绝对此做出评价。 The central bank is unlikely to yield to such pressure. Since the 1980s, the Fed has vigorously defended its mandate to maximize employment and seek stable prices, which in recent years it has formalized by aiming to keep inflation around 2%, a level consistent with healthy economic growth. 央行不可能屈服压力。自上世纪八十年代以来,美联储坚定地捍卫其扩大就业和稳定物价的使命,近年来,将通胀控制在2%左右成为固定任务,他们认为这一水平符合健康的经济增长。 Monetary policy isn’t the only reason the dollar has strengthened this year. Mr. Trump’s own policies—including the tax cut the president signed into law last December and the federal spending increase he approved in February—have also contributed to stronger economic growth and higher budget deficits, which put upward pressure on the U.S. currency. 货币政策并非今年美元走强的唯一理由。特朗普先生自己的政策,包括总统去年十二月签署的减税法案和2月批准的联邦支出增长,同样让经济增长更加强劲、预算赤字更高,而这给美国货币带来升值压力。 Recent currency strength could be exacerbated because the Fed is ahead of other global central banks in lifting interest rates after nearly a decade of efforts to stimulate growth by keeping rates at ultralow levels. 最近货币还将进一步走强,原因是美联储先于全球各央行提高利率,此前近十年来美联储一直将利率保持在超低水平来刺激增长。 Europe is “making money easy, and their currency is falling,” Mr. Trump told CNBC Thursday. “China, their currency is dropping like a rock. Our currency is going up.” The euro is down 5.3% versus the dollar since early February, while the yuan is down 7.5% against the dollar from its recent high, also in early February. 欧洲“在放松银根,欧元在贬值”,特朗普周四对CNBC说。“在中国的货币也飞流直下,我们的货币却在走强。”二月初以来,欧元对美元下跌了5.3%,人民币从二月初的高点一路下跌了7.5%。 Should Mr. Trump follow through with imposing tariffs on more goods, such as European cars, any potential shocks could encourage monetary policy authorities abroad to keep interest rates lower than they might otherwise be. 如果特朗普先生坚持对更多商品征收关税,如欧洲的汽车,造成的潜在后果都会鼓励海外的货币政策当局比正常情况更大幅度地压低利率。 With the U.S. economy expanding solidly, unemployment low and inflation around 2%, the Fed is closer than it has been in more than a decade to achieving its goals. Mr. Trump’s fiscal policies, which are projected to stimulate growth this year and next, have also given the Fed greater conviction to continue with rate increases. 美国经济稳步扩张,失业率低,通胀保持在2%,美联储用了十多年接近了这些目标。特朗普先生的财政政策旨在今年和明年刺激增长,这也让美联储进一步相信要继续加息。 Fed officials voted in March and June to raise interest rates and have penciled in two more rate increases this year. 美联储官员三月和六月投票支持加息,今年还有两次加息的空间。 A Trump administration official said Friday the White House was comfortable with the Fed’s plans but hoped the central bank would only raise rates once more this year. 特朗普政府官员周五说,白宫认为美联储的计划没问题,但希望央行今年再加一次息。 Central banks and bond investors have argued that an independent central bank is important to guard against inflation, after political interference in the 1960s and 1970s was widely blamed for contributing to runaway inflation. 央行和债权投资者认为央行独立对抵御通胀是重要的,人们认为六十年代和七十年代的政治干预导致了通胀一发不可收拾。 After Mr. Trump’s initial comments about the Fed ricocheted through currency and bond markets on Thursday, the White House sought to clarify them by saying he still respected the Fed’s independence. 特朗普对美联储的最初评论导致周四货币和债券市场震荡,此后白宫试图做出澄清,说他仍然尊重美联储的独立性。 Friday’s statements suggest the president could continue to escalate a feud with the Fed and take aim at currency markets. 周五的声明表明,总统和美联储杠上了,他瞄准了货币市场。 An administration official said Friday that Mr. Trump was expressing in public what he has said in private for some time and that the president was neither trying to interfere with the Fed nor escalate his attacks. Still, the official acknowledged the possibility that such an escalation could happen later because it was difficult to predict what Mr. Trump might do. 周五一名政府官员说,特朗普先生公开说了他私下里说的话,总统不准备干预美联储,也不准备把攻击升级。但这名官员还承认也可能此后又升级了,因为谁也预料不到特朗普先生会怎么做。 The president has been silent about Fed policy until now, in keeping with a tradition that stretches back through at least three administrations of both parties of refraining from commenting on central bank decisions in respect for its independence. 此前,总统对美联储的政策一直保持沉默,这是至少此前三界政府的惯例,无论共和党政府还是民主党政府,他们不对央行政策作出评论,尊重其独立性。 “The president has a certain style. He wants to get in on all these debates,” said St. Louis Fed President James Bullard on Friday. “He’s going to weigh in…. He’ll probably weigh in lots in the future. Different presidents have different styles. That’s the way it is.” “总统有自己的风格。他希望加入一切争论,”圣路易斯储备银行主席詹姆斯·布拉德周五说。“他想加入进来……他未来可能更进一步。不同的总统有不同的风格,就是这样。” Mr. Bullard said the bigger threat to the Fed would be if Congress were to amend legislation that changes the governance structure of the central bank. “The structure is already designed to put a big committee together and try to get a lot of analysis behind these decisions,” he said. 布拉德先生说对美联储更大的威胁是国会是否会修改立法,改变央行的治理结构。“目前的结构已经把人数众多的委员会凑到一起,在做决定前进行大量分析。” Fed Chairman Jerome Powell was in Argentina on Friday for the Group of 20 summit of finance ministers, which Treasury Secretary Steven Mnuchin is also set to attend. 美联储主席杰罗米·鲍威尔周五人在阿根廷参加G20财长会,财长斯蒂文·姆钦也准备参加。 Mr. Powell said last week he wasn’t worried about political pressure from the White House. “We do our work in a strictly nonpolitical way, based on detailed analysis, which we put on the record transparently,” Mr. Powell said in an interview with American Public Media’s “Marketplace” radio program. 鲍威尔先生上周说,他不担心来自白宫的政治压力。“我们严格以非政治的方式行事,依据具体分析,一切都公开透明。”鲍威尔接受美国公共媒体“市场”广播节目采访时这样说。 Mr. Trump’s public willingness to break with the convention of avoiding comment on the Fed might in part reflect the departure earlier this year of his former economic adviser Gary Cohn. Mr. Cohn had pressed his boss to avoid commenting on the central bank. 特朗普打破不对美联储指手画脚的传统,这种公开的企图可能部分反映在年初前经济顾问加里·科恩离职一事上。科恩先生对他的老板施压,要求总统不要评论央行。 Mr. Trump has repeatedly referred to himself as a “low-interest rate person,” reflecting in part his career in real estate. Few industries have benefited as much from the Fed’s campaign over the past decade to stimulate growth as the real-estate industry. 特朗普先生多次讲自己称为“低利率总统”,这部分反映出他从事房地产业的经理。过去十年,很少有行业像房地产业一样受益于美联储刺激增长的行动。 Mr. Trump’s new economic adviser, Lawrence Kudlow, has in the past warned against political officials pushing the Fed too far. “Republicans attacking [Fed Chairwoman Janet] Yellen…should be careful what they wish for,” he wrote in a CNBC commentary in 2015. 特朗普先生的新经济顾问劳伦斯·库德洛也曾警告政治官员不要逼美联储太甚。“攻击耶伦的共和党人……要小心,”他2015年在CNBC评论中写道。 In the same article, Mr. Kudlow highlighted the economic troubles that followed President Richard Nixon’s efforts to influence the Fed. 在同一篇文章中,库德洛特别提到理查德·尼克松总统影响美联储而造成的经济问题。

-

华尔街情报圈

-

英国金融时报

-

华尔街见闻

-

路透早报